thyssenkrupp nucera: Off to a Strong Start in the New Fiscal Year

• Strong growth at thyssenkrupp nucera also in the first quarter of the new fiscal year 2023/2024

• Strong momentum for alkaline water electrolysis (AWE) for the production of green hydrogen leads to sharp rise in order intake

• Electrolysis specialist’s sales increased by more than a third to new record level

• Expected decrease in EBIT due to start-up costs in the rapidly expanding AWE business

• Confirmation of the forecast for the 2023/24 financial year

Dortmund, February 13, 2024 – thyssenkrupp nucera has made a strong start to the new 2023/2024 financial year, seizing opportunities in the dynamically developing market for green hydrogen. With project execution aligning with customers’ schedules, we have successful handed over the first eight modules for shipment for the NEOM project. As one of the world’s largest green hydrogen projects currently under construction, the NEOM project in Saudi Arabia marks a significant milestone. The assembly of the modules for the US company CF Industries and HIDC/Element One has been completed.

“The assembly of the first two modules for the production of the climate-neutral energy carrier in the USA and Saudi Arabia has been completed, and further modules are on their way to the plants. This is an important moment in the development of the global hydrogen industry − and in our history as a company,” says Dr. Werner Ponikwar, CEO of thyssenkrupp nucera. “We are on the right track and are further expanding our position as a leading global player in the market for alkaline water electrolysis.”

This was also reflected in the development in the first quarter of 2023/2024. The electrolysis specialist increased its order intake and sales in the first quarter of 2023/2024, while EBIT (earnings before interest and taxes) was − as expected − slightly negative due to investments in future growth and a lower gross margin as a result of the alkaline water electrolysis (AWE) segment accounting for a higher proportion of total sales.

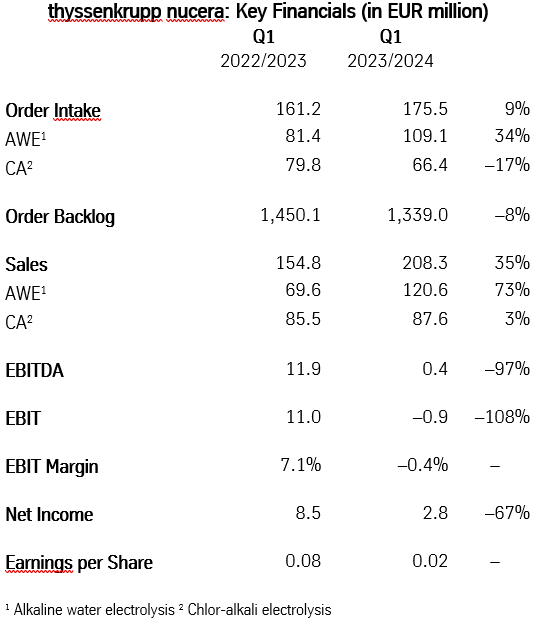

thyssenkrupp nucera increased its order intake in the first quarter by 8.8% to EUR 175.5 million (prior-year quarter: EUR 161.2 million). More than half of the new orders (EUR 109.1 million) were attributable to the AWE segment (prior-year quarter: EUR 81.4 million). The high demand for highly efficient AWE technology for the production of green hydrogen was primarily driven by another significant order milestone with the Swedish customer H2 Green Steel.

thyssenkrupp nucera is supplying electrolyzers with an installed capacity of more than 700 megawatts (MW) to H2 Green Steel for the construction of one of the largest integrated green steel plants in Europe. In the course of reaching the next project stage, an order intake of around EUR 100 million was recorded in the reporting period.

The chlor-alkali (CA) segment contributed EUR 66.4 million to order intake (prior-year quarter: EUR 79.8 million). CAPE IGARASSU, a company managed by the Chlorum Solutions Group, was another company that decided to convert an existing chlor-alkali plant in Brazil into a more environmentally friendly solution using thyssenkrupp nucera technology.

The order backlog reached EUR 1,339.0 million in the first quarter after EUR 1,450.1 million in the same period of the previous year.

With an increase in sales of 34.6% to EUR 208.3 million (prior-year quarter: EUR 154.8 million), thyssenkrupp nucera achieved its highest ever quarterly sales. The business with water electrolyzers grew the most. At EUR 120.6 million, sales in the AWE segment exceeded the previous year’s level (EUR 69.6 million) by 73.3% and set a new record.

This positive development reflects in particular the progress of the NEOM project in Saudi Arabia. The Unigel project in Brazil also contributed to positive sales development. AWE technology is being used in the first plant for green hydrogen on an industrial scale in Brazil.

In the Chlor-Alkali segment, sales developed slightly positively, reaching EUR 87.6 million (same quarter of the previous year: EUR 85.5 million). The increase in sales in new business was partially offset by falling sales in the service business.

The electrolysis specialist maintained the high pace of implementation of its growth strategy in the first quarter of the new financial year 2023/2024. Project progress in cell and module production accelerated − also due to the consistent expansion of capacities. As of December 31, 2023, the company employed 765 people worldwide, 220 more than on the same date in the previous year.

As expected, higher structural and development costs in the rapidly growing business with water electrolyzers for the production of green hydrogen and a lower gross margin, in particular, caused earnings before interest and taxes (EBIT) to fall to EUR -0.9 million (same quarter of the previous year: EUR 11.0 million). The EBIT margin weakened from 7.1% to -0.4%.

Higher interest income caused the financial result to rise sharply from EUR 0.5 million to EUR 5.8 million. Net financial assets amounted to EUR 761.4 million as of December 31, 2023 (September 30, 2023: EUR 761.3 million) and formed a strong net financial asset position to finance the growth plans.

After taxes on income and earnings, the net result of EUR 2.8 million was below the previous year’s level (prior-year quarter: EUR 8.5 million). Earnings per share attributable to the shareholders of thyssenkrupp nucera fell accordingly to EUR 0.02 (prior-year quarter: EUR 0.08).

“In order to implement our growth strategy swiftly and take advantage of market opportunities, we expect start-up costs to continue to rise in the coming quarters,” says Dr. Arno Pfannschmidt, CFO of thyssenkrupp nucera.

thyssenkrupp nucera confirms its forecast. The company continues to expect significant sales growth in the mid double-digit percentage range for the 2023/2024 financial year compared to the past 2022/2023 financial year. The expected growth momentum will mainly be driven by the execution of already contractually agreed projects in the AWE area. The necessary start-up costs for the implementation of the growth strategy and the scaling of the AWE business for the long-term and sustainable improvement of competitiveness and profitability will probably necessitate a negative EBIT in the mid double-digit million euro range.

Rita Syre

Senior Media Relations Manager

Mobile: +49 174 161 86 24

E-Mail: rita.syre@thyssenkrupp-nucera.com

Would you like to join our press mailing list?

Send us an email to press@thyssenkrupp-nucera.com with the subject „Press Releases“ and always receive the latest news!

More press releases