thyssenkrupp nucera achieves robust growth despite challenging environment

- Positive momentum in the electrolysis specialist’s incoming orders for the third quarter

- Record sales achieved in the third quarter due to scheduled implementation of chlor-alkali and water electrolysis projects

- High R&D expenditure to strengthen competitive position

- Resilient profitability supported by the chlor-alkali business and effective cost containment

- Strong financial reserves available for future growth

- Forecast for 2023/2024 has been confirmed

Dortmund, August 13, 2024 – thyssenkrupp nucera maintained its growth trajectory in the third quarter of the current 2023/2024 financial year. De spite the ongoing challenges in the market for green hydrogen, the electrolysis specialist’s strong performance enabled it to exceed market expectations.

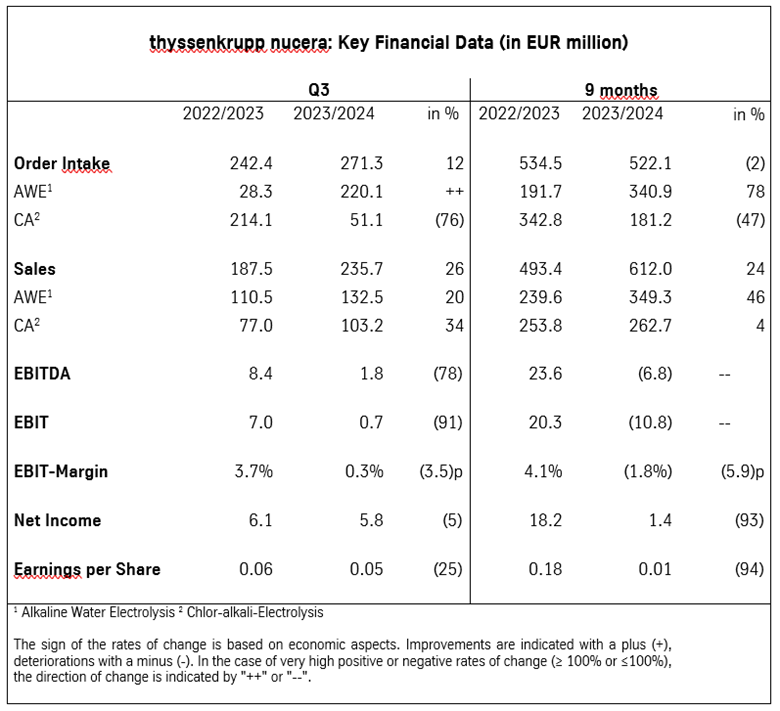

The world’s leading provider of electrolysis technologies significantly increased its order intake in the third quarter of the 2023/2024 reporting year by 12% to EUR 271.3 million compared to the same quarter of the previous year (EUR 242.4 million). The main driver of growth in customer orders is once again the alkaline water electrolysis (AWE) segment.

In the business with the highly efficient AWE technology for the production of green hydrogen, the company recorded a volume of customer orders amounting to EUR 220.1 million (prior-year quarter: EUR 28.3 million). Following the receipt of the full notice to proceed from the customer, around EUR 200 million was booked from the H2 Green Steel project. thyssenkrupp nucera is a partner of the Swedish company in the construction of Europe’s first large-scale green steel plant.

Spain’s Cepsa and thyssenkrupp nucera have signed an agreement to reserve production ability for an electrolyzer with a capacity of 300 megawatts. In the Cepsa energy park in La Rábida in Palos de la Frontera (Huelva), the water electrolysis plant will produce 47,000 tons of green hydrogen per year in a first phase.

thyssenkrupp nucera is also making very good progress with the construction of the water electrolyzer plant in NEOM, Saudi Arabia, with an output of more than 2 gigawatts. The delivery of standardized 20 MW modules to NEOM has already reached a capacity exceeding 800 megawatts, with over 400 megawatts successfully installed. A corresponding assembly hall has been put into operation for on-site cell assembly.

“We have also reached a very important milestone in the project execution: our water electrolyzer with a capacity of 20 megawatts at CF Industries in the USA is already producing the first green hydrogen. The start of full-scale hydrogen production is imminent. The 20 MW water electrolyser is part of the decarbonization efforts at the world’s largest ammonia production site. Now, more thyssenkrupp nucera electrolyzers will start operating worldwide on an ongoing basis, enabling the production of urgently needed green hydrogen for the decarbonization of heavy industry,” says Dr. Werner Ponikwar, CEO of thyssenkrupp nucera.

Despite new projects, growth momentum was also significantly slowed in the third quarter due to the prevailing uncertainty in the market for green hydrogen. Unresolved regulatory issues and a slow pace of funding commitments led to delays in the final investment decision ( FID) of many potential customers regarding the necessary electrolysis capacities.

The chlor-alkali (CA) business developed very well in the third quarter. thyssenkrupp nucera expects projects with chlorine production capacities of more than one million tons per year to reach the FID stage in the next 18 months. In the United Arab Emirates, the company was awarded the contract to prepare a basic engineering and design package for one of the largest chlor-alkali plants in the world. Further feasibility studies for plants are currently being carried out in Spain, South America and the USA.

Order intake in the chlor-alkali electrolysis segment amounted to EUR 51.1 million in the reporting period. In the same period of the previous year, the figure had risen exceptionally sharply to EUR 214.1 million due to the major OxyChem order in the USA. thyssenkrupp nucera and the US chemical company are working together on the introduction of the latest generation of eBiTAC v7 electrolyzers for the conversion of the Battleground plant in LaPorte, Texas, from diaphragm to membrane technology.

Incoming orders remained stable in the first nine months of 2023/2024. At EUR 522.1 million, it was down slightly (minus 2%) on the same period of the previous year (EUR 534.5 million). The AWE business contributed EUR 340.9 million (prior-year period: EUR 191.7 million) and the Chlor-Alkali division EUR 181.2 million (prior-year period: EUR 342.8 million).

At EUR 1.3 billion (June 30, 2024), the order backlog was once again high (previous year: EUR 1.5 billion). It amounted to EUR 0.9 billion in the AWE segment (June 30, 2023: EUR 1.0 billion) and EUR 0.4 billion in the CA business (June 30, 2023: EUR 0.5 billion).

Sales developed more dynamically than incoming orders. At EUR 235.7 million, sales in the third quarter of 2023/2024 exceeded the comparative figure (EUR 187.5 million) by more than a quarter (26%). The electrolysis specialist thus achieved its highest quarterly revenue ever thanks to the ongoing implementation of CA and AWE projects. Sales of innovative solutions for the production of climate-neutral green hydrogen for the decarbonization of industry grew strongly by a fifth (20%) to EUR 132.5 million (prior-year period: EUR 110.5 million).

The high sales growth primarily reflects the work underway at full speed in the construction of the plants, in particular the more than 2 gigawatt AWE plant in NEOM in Saudi Arabia and the progress of the H2 Green Steel project, which is also on schedule. Sales in the Chlor Alkali division rose significantly by 34% year-on-year to EUR 103.2 million (prior-year quarter: EUR 77.0 million), not only due to the service business but also the new construction business.

In the first nine months, total sales grew by 24% compared to the previous year and reached EUR 612.0 million (previous year: EUR 493.4 million). thyssenkrupp nucera increased sales in both divisions: Sales growth in the AWE business 46% to EUR 349.3 million (prior-year period: EUR 239.6 million) and in the CA business 4% to EUR 262.7 million (prior-year period: EUR 253.8 million). “Our business model with the two portfolio elements, i.e. the stable development of the chlor-alkali business and the green hydrogen business for decarbonizing heavy industry, continues to be very advantageous. With our robust business model, we are also very well positioned for times with more difficult market conditions,” says Dr. Arno Pfannschmidt, CFO of thyssenkrupp nucera.

EBIT (earnings before interest and taxes) fell to EUR 0.7 million (prior-year quarter: EUR 7.0 million) due not only to the intensification of research and development work in the field of alkaline water electrolysis but also to further planned upfront expenditure as part of the implementation of the AWE growth strategy. As in the previous quarter, thyssenkrupp nucera almost doubled its research and development costs from EUR 5.1 million to EUR 10.5 million.

The high growth momentum was accompanied by continued stable profitability thanks to the CA business. However, the high contribution of AWE to total sales and the increase in other costs of sales due to the AWE ramp-up and capacity expansion caused the EBIT margin to fall to 0.3% (prior-year period: 3.7%). In the first nine months, EBIT fell significantly to EUR -10.8 million (prior-year period: EUR 20.3 million).

In the third quarter of the financial year, the electrolysis specialist continued to press ahead with the successful implementation of its growth strategy. The provider of leading global technologies for highly efficient electrolysis systems further strengthened its organization. As of June 30, 2024, thyssenkrupp nucera employed 944 people worldwide, an increase of 316 compared to the previous year (628 employees as of June 30, 2023).

thyssenkrupp nucera improved its financial result to EUR 7.0 million (prior-year quarter: EUR 1.8 million) due to higher interest income. At EUR 5.8 million, net income after income taxes was almost on par with the same period of the previous year (EUR 6.1 million) despite the decline in EBIT. Earnings per share fell slightly in the third quarter to EUR 0.05 (same quarter of the previous year: EUR 0.06).

In the first nine months of 2023/2024, higher interest income was the main driver behind the improvement in the financial result to EUR 18.8 million (prior-year period: EUR 5.0 million). After income taxes, the net result amounted to EUR 1.4 million (same period of the previous year: EUR 18.2 million).

The Executive Board confirms the sales and earnings forecast for the 2023/2024 financial year. thyssenkrupp nucera expects sales in the range of EUR 820 million to EUR 900 million for the 2023/2024 financial year. This increase is expected to be driven primarily by the completion of projects already contractually agreed in the field of alkaline water electrolysis. The previous sales forecast of EUR 500 million to EUR 550 million also continues to apply to the alkaline water electrolysis segment.

The electrolysis specialist continues to expect EBIT to be negative in the mid double-digit million euro range (2022/2023: EUR 23.8 million). The decline in EBIT is primarily due to the expansion of the currently still lower-margin hydrogen segment as a result of planned increases in research and development costs as well as higher administrative and sales costs for the implementation of the growth strategy and organizational development.

“The market for green hydrogen continues to have very high growth potential. This needs to be leveraged despite the delays inherent in the market. And that is what we are doing. At thyssenkrupp nucera, we are not just waiting for changes, we are taking the necessary measures,” said Dr. Werner Ponikwar, CEO of thyssenkrupp nucera. “We continue to focus on the profitable execution of our orders, intensify our sales efforts in different regions and industries, align our organizational and operational set-up with the changing market developments to secure our profitability and liquidity, and strengthen our R&D activities to further expand our competitive position,” added the CEO of thyssenkrupp nucera.

Rita Syre

Senior Media Relations Manager

Mobile: +49 174 161 86 24

E-Mail: rita.syre@thyssenkrupp-nucera.com

Would you like to join our press mailing list?

Send us an email to press@thyssenkrupp-nucera.com with the subject „Press Releases“ and always receive the latest news!